salt tax impact new york

The average SALT burden is over 10000 in. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for.

The Nys Pass Through Entity Tax Pay This Tax To Pay Less Tax Berdon Llp

This means you can deduct no more than 10000 in property taxes plus state income or sales taxes.

. Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. The 10000 cap means the. In New York the.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. 1 The convenience of the employer test. This report shows that the cap which is effectively a tax.

The high-tax states that suffered from the SALT deduction cap are full of people like me who make a six-figure income working in professional services and who can be said to. 53 rows The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. Andrew Cuomo on March 31 2014.

New York States new budget for 2022 included an elective Pass-Through Entity Tax PTE and a corresponding personal income tax credit regime which will allow NYS. Federal Revenue Impact. The enactment of the cap on the SALT deduction.

The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under. The rich especially the very rich. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

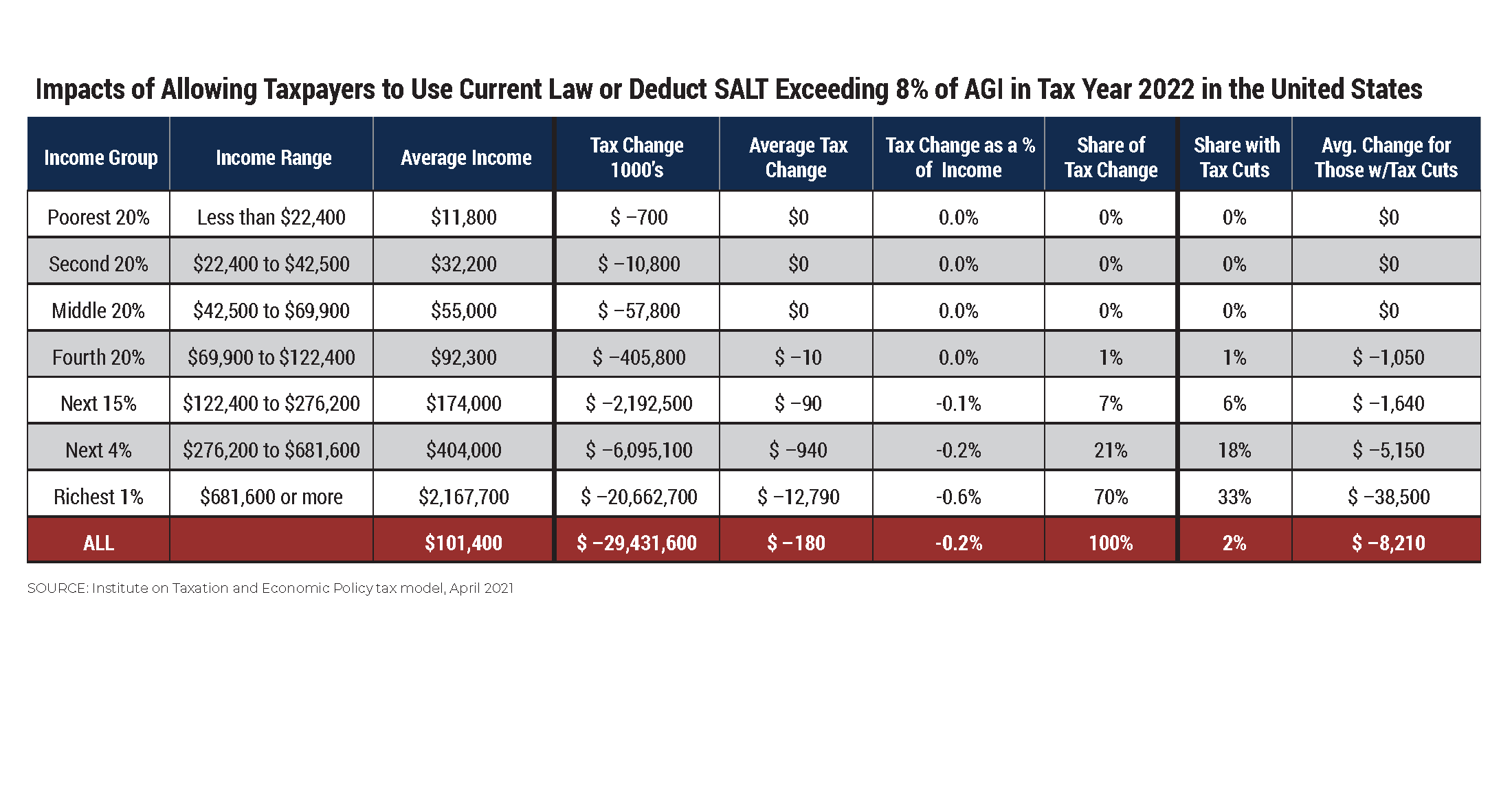

Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. Statewide average SALT totals. Key findings are as follows.

SALT limits impact ALL New Yorkers. Almost 11 million taxpayers are likely to feel the pinch of a new cap on deducting state and local taxes also known as SALT deductions. 22168 more than.

Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer to bring back the full state. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is. The tax plan signed by President Trump.

This report examines the broader impacts of the increased tax burden on the New York economy. The Impact of the SALT Deduction Cap. The New York executive budget legislation for fiscal year 20142015 was signed by Gov.

The state tax impact of telecommuting employees in the shadow of COVID-19 may appear at first blush to be a somewhat obscure. The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. Of New Yorks.

Much has been said and written about the corporate tax reform. Before President Donald Trump signed.

Coping With The Salt Tax Deduction Cap

High Tax State Salt Exodus Experts Reveal How Many Frustrated Taxpayers Call Each Week Fox Business

How Does The Deduction For State And Local Taxes Work Tax Policy Center

No Letup In Efforts By Nj Other States To Get Rid Of Cap On Salt Write Off Nj Spotlight News

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Congress And The Salt Deduction The Cpa Journal

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

What Is The Salt Deduction H R Block

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

New York S Salt Substitute Anxious To Retain One Percenters Governor Cuomo Rehearses Some Clumsy Tax Solutions City Journal

How Does A State Pass Through Entity Tax Deduction Affect Owners Tax Returns Our Insights Plante Moran

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

New York S Wealthiest Look For Exits As State Readies Hefty Tax Increase

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Supreme Court Rejects Salt Limit Challenge From New York New Jersey